2103AFE Company Accounting

Section 1: Consolidation Case Study – Galaxy Ltd and Moon Ltd (Total 70 marks)

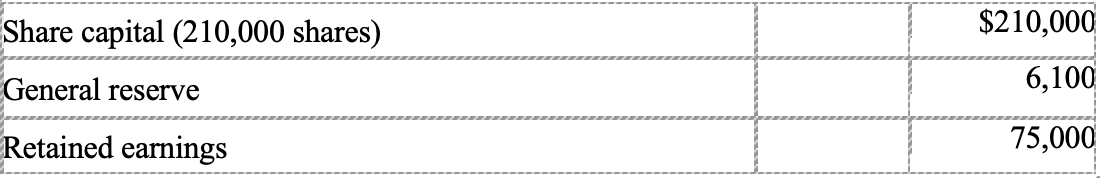

Galaxy Ltd acquired 80% of the share capital of Moon Ltd on 1 July 2012. The following equity balances appeared in the records of Moon Ltd at the date of acquisition:

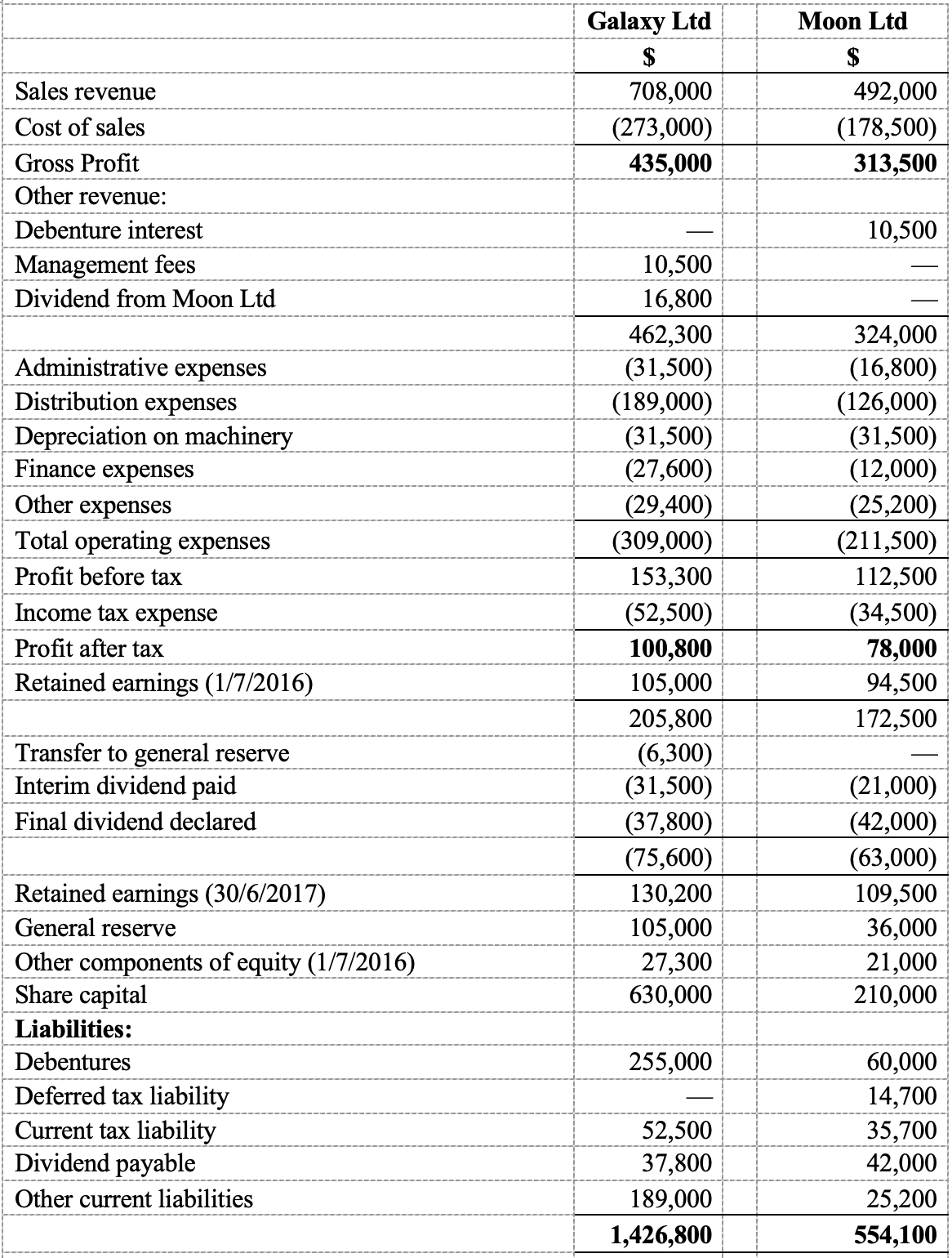

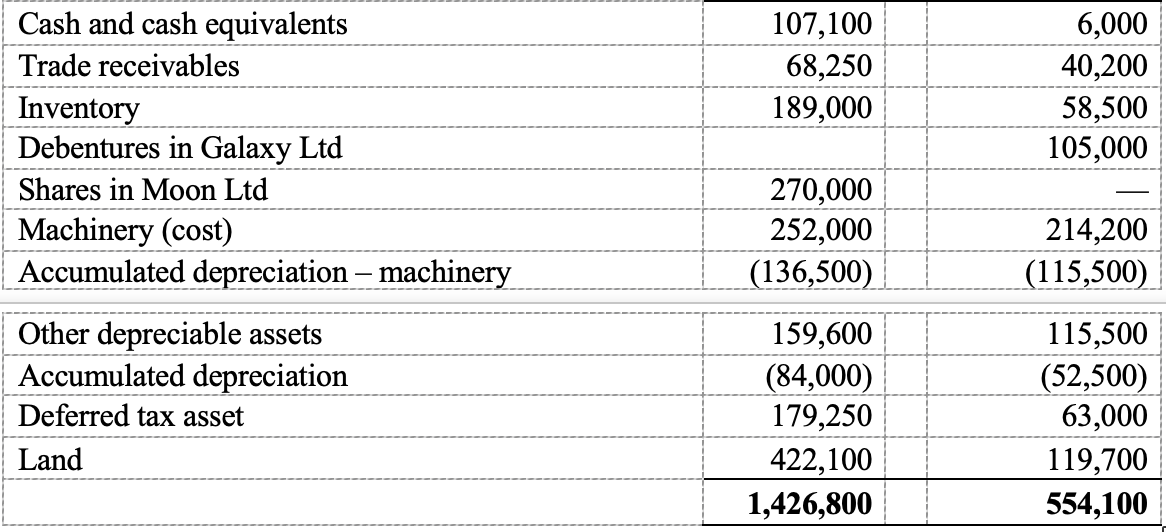

Financial information at 30 June 2017 of Galaxy Ltd and its subsidiary company, Moon Ltd, is shown below.

Additional information

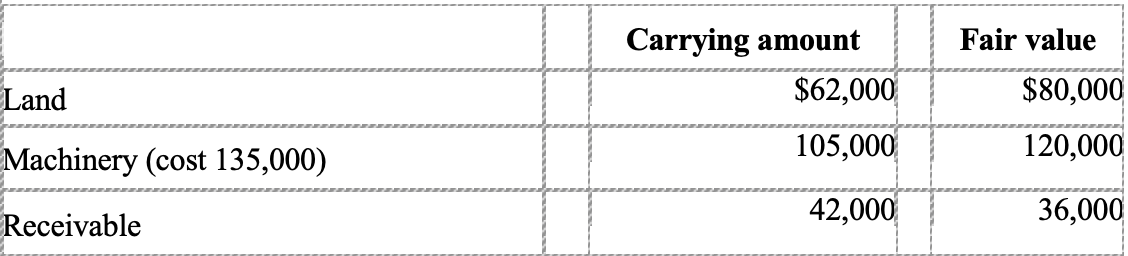

1. At 1 July 2012, all the identifiable assets and liabilities of Moon Ltd were recorded at fair value except for the following assets:

The machinery has an expected life of 10 years, with benefits being received evenly over that period. Differences between carrying amounts and fair values are adjusted on consolidation. The land on hand at 1 July 2012 was sold on 1 March 2014 for $84,000. Any valuation reserve in relation to the land is transferred on consolidation to retained earnings. By 30 June 2013, receivables had all been collected.

2. Galaxy Ltd uses the full goodwill method. The fair value of the non-controlling interest at 1 July 2012 was $66,000.

3. Opening inventory of Moon Ltd includes unrealised profit of $5,000 on inventory sold by Galaxy Ltd. It was all sold by Moon Ltd during the year.

4. During the year, intragroup sales by Moon Ltd to Galaxy Ltd were $80,000. The mark-up on cost of all sales was 25%. At 30 June 2017, Galaxy Ltd’s inventory included $35,000 of items acquired from Moon Ltd.

5. On 1 January 2017, Moon Ltd sold an item of inventory to Galaxy Ltd for $18,000 at a profit before tax of $3000. Galaxy Ltd had treated this item as an addition to its machinery and depreciated at 10% p.a. straight-line.

6. On 1 April 2017, Galaxy Ltd sold $15,000 worth of inventory to Moon Ltd. The cost of this inventory was $9000. By 30 June 2017, Moon Ltd had sold 60% of the inventory to outside entities.

7. Some of the items manufactured by Moon Ltd are used as machinery by Galaxy Ltd. One of the machinery items held by Galaxy Ltd at 30 June 2017 was purchased from Moon Ltd on 1 January 2016. It had cost Moon Ltd $17,500 to manufacture this item and was sold to Galaxy Ltd for $25,000. Galaxy Ltd depreciates such items at 10% p.a. on cost.

8. Management fees derived by Galaxy Ltd were all from Moon Ltd and represented charges made for administration.

9. The tax rate is 30%.

Required:

a) Prepare the acquisition analysis at 1 July 2012. (10 marks)

b) Prepare the consolidation journal entries, including:

-

- The business combination valuation entries; (6 marks)

- The pre-acquisition entries; (5 marks)

- The intra-group entries (considering the effects on non-controlling interests); (26 marks)

c) Calculate NCI share of equity at following dates and prepare the journal entries (not considering the effects of intra-group transactions):

-

- 1 July 2012; (3 marks)

- 1 July 2012 – 30 June 2016; (4.5 marks)

- 1 July 2016 – 30 June 2017. (3.5 marks)

d) Show the balance of following accounts presented in the consolidated financial statement

-

- The balance of Non-Controlling Interests in the consolidated financial statement; (5.5 marks)

- The balance of Business Combination Revaluation Reserve (BCVR) in the consolidated financial statement; (3 marks)

- The balance of Deferred Tax Assets in the consolidated financial statement; (3.5 marks)

Section 2: Case Study (Total 30 marks)

Visit the website of Telstra Group Ltd (https://www.telstra.com.au/content/dam/tcom/about-us/investors/pdf%20F/2020-Telstra-Annual-Report.pdf ) and retrieve the 2020 annual report.

Required

- Identify the principles of consolidation used as disclosed in the consolidated financial statements and explain how this company has complied with the requirements of AASB 10 Consolidated Financial Statements. (6 marks)

- Explain the concept of “subsidiary”. Identify the major subsidiaries, as disclosed in the notes to the consolidated financial statements. (4 marks)

- Read this company’s “related party disclosure” and identify the intra-group transactions. Explain how to account for intra-group transactions in the principles of consolidation (6 marks)

- Identify the following amounts in the consolidated financial statements:

- What is the amount of total comprehensive income for the group for the year ended 30 June 2020? (1 mark)

- Show the amount of this comprehensive income that is attributable to shareholders of the parent entity and non-controlling interest. (2 marks)

- What is the amount of goodwill at 30 June 2020? (1 mark)

- Discuss potential reasons the regulators require Telstra Group Ltd to prepare consolidated financial statements. (5 marks)

- How are the consolidated financial statements impacted by COVID-19, using the facts in Telstra Group’s annual report to justify your answers? (5 marks)

“You can order 2103AFE Company Accounting : Practice-Based Assignment from our service and can get a completely high-quality custom paper. Our service offers any of the 2103AFE Academic paper written from scratch, according to all customers’ requirements, expectations and highest standards.”

100% Plagiarism Free

24X7 Customer Support

Multiple Revisions

100% Confidential

On-time Delivery

500+ Experts