Module Code: AC4052QA

Module Title: Financial Accounting

Word count: Section A 1200 words and Section B 300 words (Max of 1500 words)

Requirements:

This coursework has two sections. Section A has one question and Section B has two questions. ANSWER ALL QUESTIONS IN BOTH SECTIONS A and B.

SECTION A

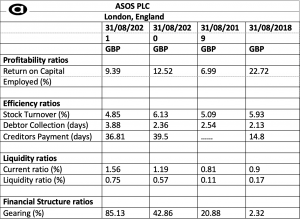

This assignment requires each student to work on the published financial statements of ASOS PLC for the last three years from 2018 to 2021.

You are required:

Write a report to evaluate the profitability, efficiency, liquidity, and financial structure of ASOS over the financial periods 2018 to 2021.You should use the accounting ratios shown below and any other information relevant to ASOS PLC. Information can be accessed from the annual report and accounts and any other source of evidence that you believe helps to explain the company’s performance and position. (40Marks)

SECTION B

Question 1 (49 Marks)

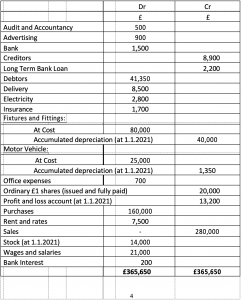

Ovid Ventures run a small private company selling swimwear from China. The owner of the Venture asked you to prepare set of financial statement for the year ended 31 December 2021 as soon as possible as the previous accountant left the company at very short notice.

Additional Information:

- Stock at 31st December 2021 valued at cost amounted to £18000.

- Depreciation is to be provided on fixtures and fittings at 25% on cost and 10% on reducing balance method for motor vehicle.

- The electricity consumed but not paid for the period is £250.

- Insurance paid in advance at 31st December 2021 amounted to £400.

Required:

- Prepare Income statement for the year ended 31st December 2021. (26 Marks)

- Prepare Balance Sheet as at 31st December 2021. (23 Marks)

Question 2 (11Marks)

- Briefly explain to Mr Ovid the owner of Ovid Ventures the impact of the following adjustments on Profit & Loss Account and Balance sheet:

- Prepaid Expenses

- Accrued Expenses

- Prepaid Income

- Accrued Income (8 Marks)

- Briefly explain to the Mr Ovid the owner of Ovid Ventures why the following items will be added back or deducted from the cash flow statement using the indirect method:

- Depreciation

- Disposal of non-current asset

- An increase in inventories (3 Marks)

“You can order AC4052QA Financial Accounting Assignment from our service and can get a completely high-quality custom paper. Our service offers any of the AC4052QA Academic paper written from scratch, according to all customers’ requirements, expectations and highest standards.”

100% Plagiarism Free

24X7 Customer Support

Multiple Revisions

100% Confidential

On-time Delivery

500+ Experts