Module Code: BA4008QA

Module Subject: Business Decision Making

Coursework 2 (Individual Coursework)

TASK ONE (70 marks)

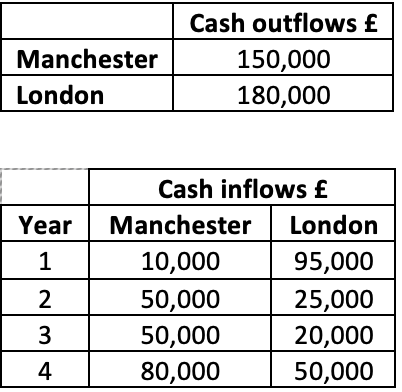

The Senior management at Aisha Plc have identified that there is a strategic need for a project in Manchester or in London. The Manchester project is expected to have a scrap value of £10,000 and the London project is expected to have a scrap value of £40,000. The Senior management of Aisha Plc have to make a choice between the two projects. They are unsure as to which of the two models they should invest in. The company’s cost of capital is 9%.

They have given you the following cashflows of the two projects.

QUESTION 1(a) :

They want you to appraise the two prospective projects using the following investment appraisal techniques: [46 MARKS]

- Payback (8marks)

- Accounting rate of Return (10 marks)

- Net Present Value (12 marks)

- Internal Rate of Return (16 marks)

Note: Funds are only available for only one model.

QUESTION 1(b) :

Write a report (of around 500 words) to the senior management of the company explaining how each of the techniques works. Your report should include at least two advantages and two disadvantages of each technique. [16 MARKS]

QUESTION 1(c) :

Explain briefly (in around 200 words) which project you would recommend to senior management of Aisha Plc under each technique and state your reason why you would recommend that machine. [8 MARKS]

TASK TWO (26 marks)

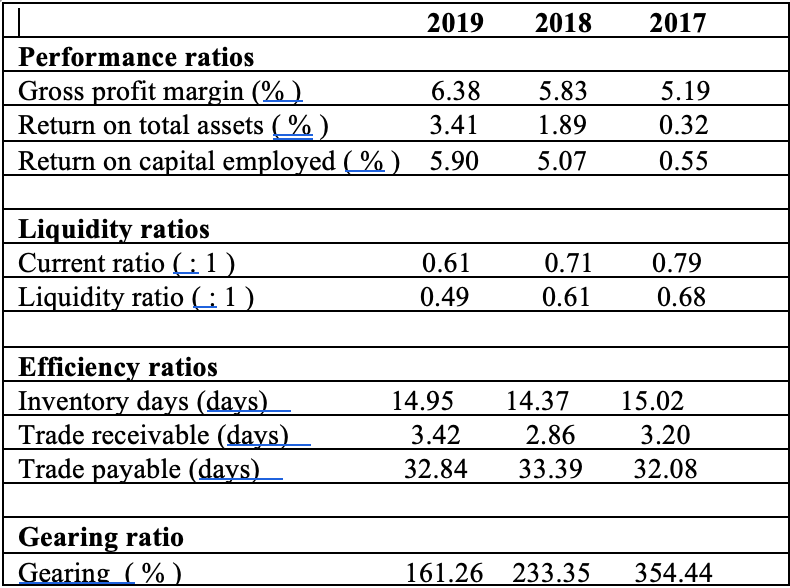

An analysis and evaluation of the performance, liquidity, and financial structure of Tesco plc over the three-year period 2017 – 2019.

QUESTION 2(a):

Explain the company’s (Tesco plc) performance and position using the accounting ratios shown below (see page 5) and any other information relevant to Tesco plc taken from the annual report and accounts for 2019 (see the link in page 6) and any other relevant source of evidence. [18 MARKS]

QUESTION 2(b):

Highlight any Five (5) limitations in the use of accounting ratios that you found in your analysis and evaluation of the company over the three-year period. This may include reference to the movements in the company’s share price particularly in 2019. [5 MARKS]

QUESTION 2(c):

Discuss other three (3) factors affecting Tesco in 2019 e.g. significant new factors affecting the company’s performance, movements in share price, current retail and market conditions. [3 MARKS]

“You can order BA4008QA Business Decision Making Coursework from our service and can get a completely high-quality custom paper. Our service offers any of the BA4008QA Academic paper written from scratch, according to all customers’ requirements, expectations and highest standards.”

100% Plagiarism Free

24X7 Customer Support

Multiple Revisions

100% Confidential

On-time Delivery

500+ Experts